“We weren’t expecting this curveball"

That’s the sentiment echoing across India’s buzzing e-commerce corridors, from tech hubs in Bengaluru to export-driven warehouses in Surat. The U.S. just slapped a whopping 26% tariff on Indian imports, and the impact? It’s nothing short of a jolt to businesses thriving on international demand — especially those sending products across the seas through platforms like Amazon, Shopify, and Etsy.

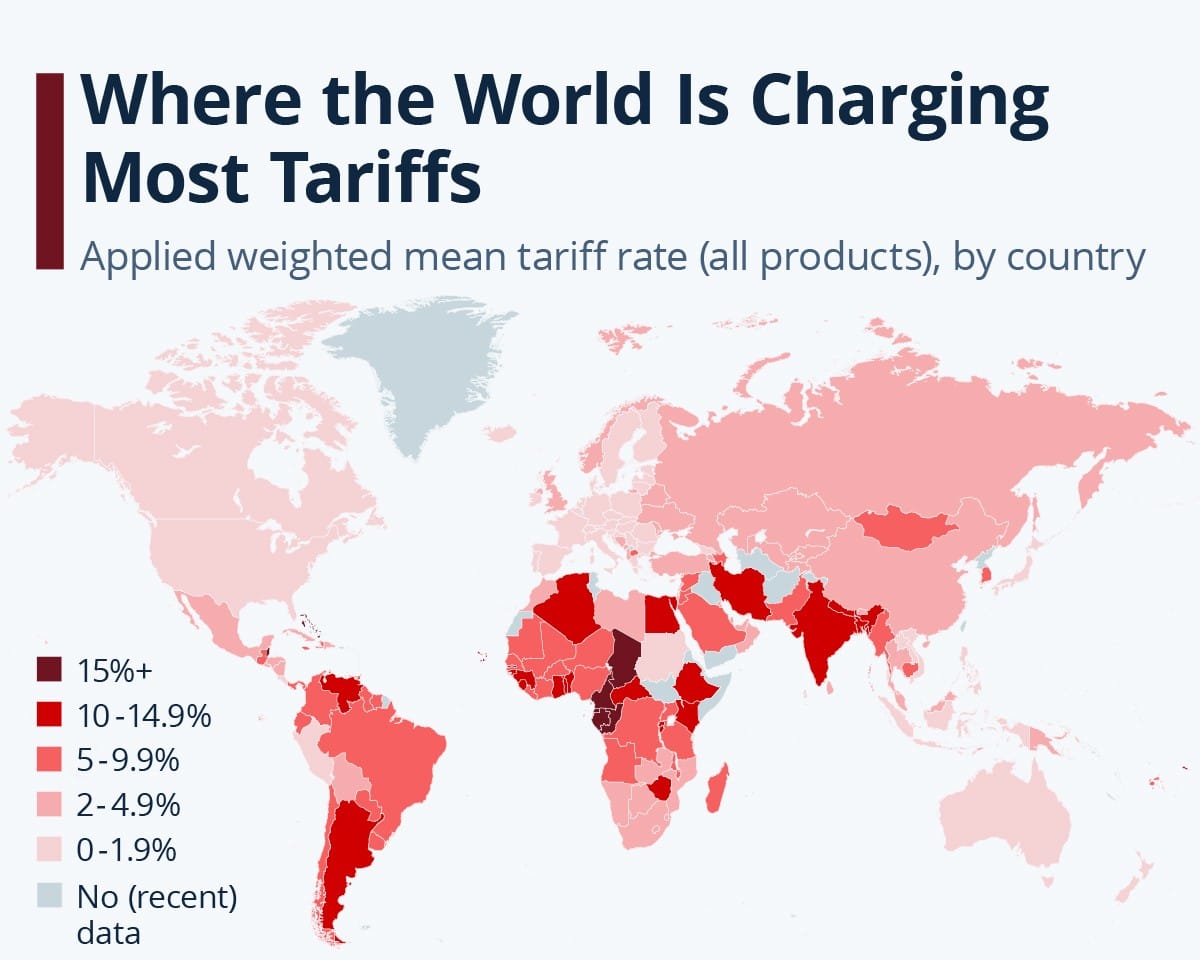

Source: Statista

On 9 April 2025, the United States — under President Donald Trump — officially imposed a 27% tariff on Indian goods entering the U.S., as part of a sweeping new protectionist trade policy. While the initial White House tariff chart listed India's rate at 26%, the signed executive order confirmed it at 27%, causing widespread confusion — and anxiety.

India, once seen as a strategic ally in America’s Indo-Pacific gameplan, now finds itself caught in the crosshairs of Trump’s boldest economic gamble yet.

🔥 From Trade Partner to Target?

Before this move, the average U.S. tariff on foreign goods was just 3.3% — among the world’s lowest. In contrast, India’s tariffs averaged 17%, prompting Trump to label India a “tariff king” and a “trade abuser”.

Now, India joins a growing list of countries facing steep penalties:

China – 54%

Vietnam – 46%

Thailand – 36%

Bangladesh – 37%

India – 27%

Clearly, this isn’t just about India — it’s about remaking the rules of global trade.

📉 The Immediate Fallout for Indian E-Commerce

Indian exporters, particularly e-commerce brands in sectors like fashion, jewelry, electronics, toys, and home goods, are suddenly in a pricing nightmare.

What was once a ₹2000 ($24) product may now cost over $30+ in the U.S., factoring in duties and shipping — killing the competitive edge many Indian sellers relied on.

Sectors at risk:

📱 Electronics (especially mobile components, chargers, wearables)

🧩 Toys and Games

🚗 Automobile components

🐟 Marine exports

🏗️ Engineering goods and light machinery

India’s ambitious Production-Linked Incentives (PLI) program, launched to boost manufacturing in electronics, may suffer a setback if these products become uncompetitive due to tariffs.

📦 Small Exporters, Big Pain

Indian e-commerce is powered by thousands of MSMEs — small sellers exporting via Amazon, Etsy, Shopify, and niche global marketplaces. These businesses were just starting to ride the cross-border wave, boosted by rising demand in the U.S. for “Made in India” goods.

Now, they’re being asked to absorb a 27% tariff or raise prices.

Both options spell trouble.

“We’re not Apple or Samsung. A 27% hike wipes out our margin — and then some,” says a Delhi-based D2C electronics founder.

Learn more about how Amazon’s models work for Indian sellers and how SellerFlex might be a game-changer.

⚖️ But Is There a Silver Lining?

Yes — and it’s a big one.

Trump’s tariff storm has hit China, Bangladesh, Thailand, and Vietnam even harder. This could open up critical market space for India, especially in:

👚 Textiles & Apparel (as Bangladesh and China face heavier duties)

🛠️ Machinery

🧪 Semiconductor packaging & testing (as Taiwan sees 32% tariffs)

According to Global Trade Research Initiative (GTRI), India stands at a strategic inflection point. If it can strengthen infrastructure, streamline trade, and attract investment, it may position itself as an alternate manufacturing hub — one that fills the vacuum left by China’s trade decoupling.

But experts caution: this opportunity is narrow and time-sensitive.

🚨 What’s Holding India Back?

“India has treated garments like a sunset sector. We didn’t invest. We didn’t build capacity,” says Biswajit Dhar of the Council for Social Development.

Some of India’s biggest barriers aren’t tariffs — they’re logistics, red tape, and unpredictable policy.

Here’s what India must fix:

🏭 Improve logistics & port infrastructure

🛃 Streamline customs and certification

🔧 Ease restrictions on key imports (like dairy, tech, and medical devices)

💼 Offer consistent trade policies

🧠 Strengthen IPR and trade secret frameworks

Without these, even the best tariff advantage will fall flat.

🧠Strategic Responses for Indian E-Commerce Businesses

To navigate these challenges, Indian e-commerce companies can consider the following strategies:

- Diversify Market Presence: Exploring and expanding into other international markets can reduce reliance on the U.S. and spread risk.

- Optimize Supply Chains: Enhancing supply chain efficiency and exploring cost-effective logistics solutions can help mitigate increased costs.

- Invest in Brand Value: Building strong brand recognition and emphasizing unique value propositions can justify premium pricing and retain customer loyalty.

- Engage in Policy Advocacy: Collaborating with industry associations and government bodies to advocate for favorable trade terms or seek exemptions can be beneficial.

👉 For more insight, read: Success in the Indian e-commerce market: Insights for Amazon sellers

📌 Final Word

This isn’t just a tariff — it’s a litmus test for India's e-commerce resilience.

🚧 Threats:

Margin erosion for thousands of MSMEs

Risk of losing ground to other developing economies

Setbacks to flagship government schemes like PLI

🚀 Opportunities:

Win market share from tariff-hit nations

Pivot to new markets and scale beyond the U.S.

Use policy pressure to accelerate India’s infrastructure and logistics reforms

The next 6–12 months are crucial. Indian e-commerce brands must choose: pivot or perish.